Understanding Hyperscale Concentration: China & South-East Asia

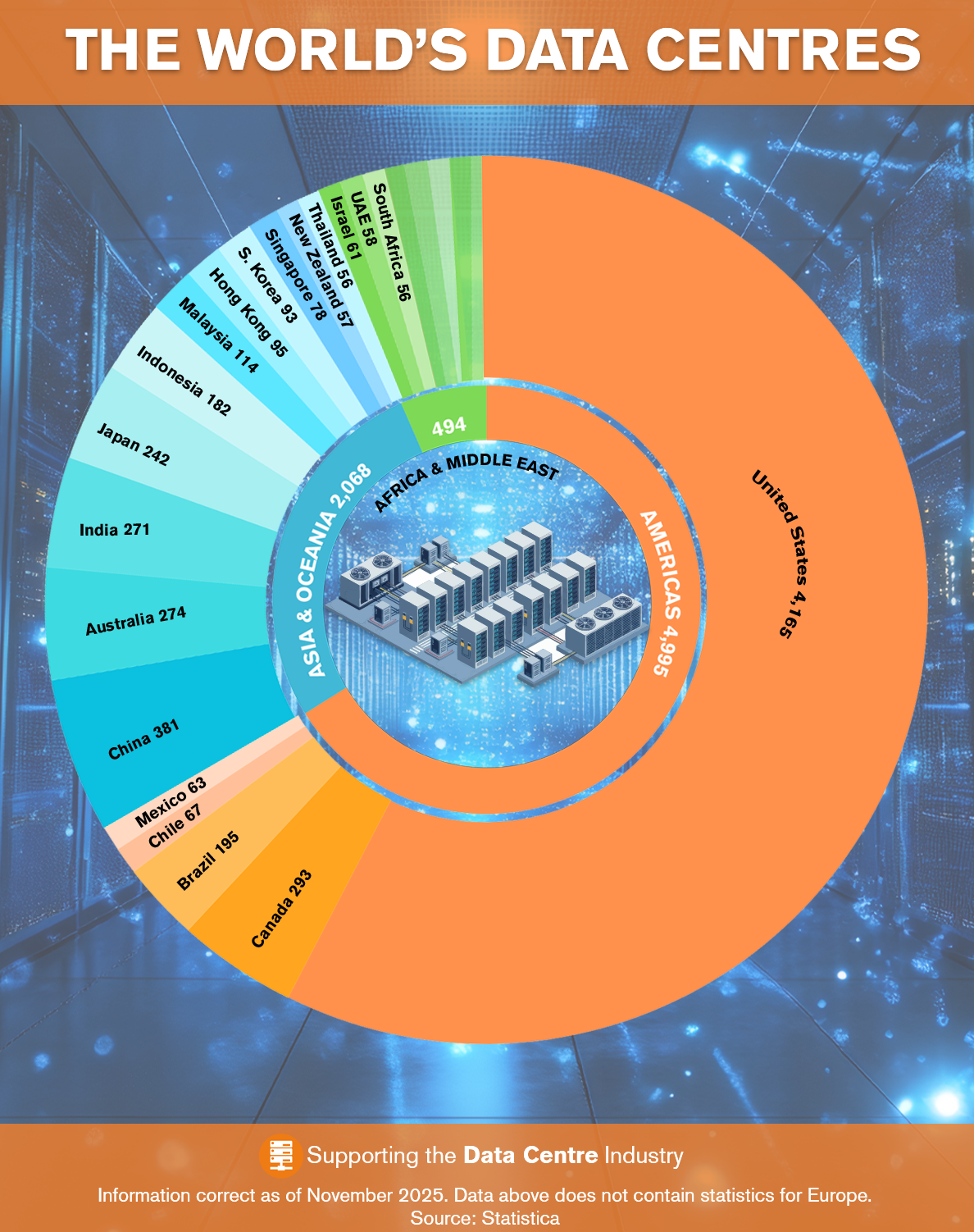

On paper you could be forgiven for thinking China and South-East Asia lag behind the US in terms of number of data centres, but behind those headline numbers there's a different story: one where capacity is a more relevant metric than an individual count.

In 2024, the world’s installed datacentre capacity reached roughly 122 GW, with the U.S. and China together accounting for around 70%—a concentration that makes simple facility count maps inherently deceptive. A single hyperscale campus in Beijing, Hebei, or Singapore can equal the power load of dozens of enterprise or colocation sites in other regions.

Across Southeast Asia, demand is accelerating even faster. The International Energy Agency estimates that electricity demand from data centres in Southeast Asia will more than double by 2030, reshaping regional load forecasting and power grid planning. This rise reflects not just the number of facilities, but the scale and intensity of hyperscale developments gravitating toward grid-rich hubs like Singapore and southern Malaysia.

Hyperscale Logic: Fewer Sites, Massive Footprints

Countries such as China and Singapore epitomise this ‘hyperscale first’ development model:

China hosts relatively fewer physical campuses than North America or Europe, but its projects often span hundreds of megawatts. Massive state-backed investments have created hyperscale zones with footprints dwarfing typical colocation builds.Singapore, despite land constraints, is the most power dense data centre market in Southeast Asia—currently accounting for 1.4 GW, or 54% of the region’s total datacentre load. While the city state caps new DC approvals, approved projects tend to be extremely high density and grid intensive.

Outside the U.S., the countries contributing most IT capacity include China and Australia regions with favourable grid access, fibre density, and regulatory frameworks that support hyperscale growth.

The Southeast Asia Surge: Power Demand Set to Quadruple

In Southeast Asia, hyperscale demand is transforming national power systems. Electricity demand from data centres in the region is projected to increase sharply, with Malaysia’s DC electricity consumption expected to rise from 9 TWh in 2024 to 68 TWh by 2030—a sevenfold jump. Regionwide forecasts show that datacentre power demand could account for 7–10% of total power demand growth over the next decade, depending on the country.

Looking ahead, global electricity consumption by data centres is projected to more than double by 2030 to ~945 TWh, with AI as the primary driver. Some analysts see even steeper growth: Goldman Sachs forecasts up to a 165% rise by 2030 (vs. 2023), while BloombergNEF’s latest outlook suggests demand could reach ~2.7× (nearly triple) by 2035. These macro pressures reinforce why MW capacity, not site count, is the metric that matters

Understanding What Really Signals Scale

As AI transforms global compute needs, for regions like China, Singapore, and Malaysia it is hyperscale concentration—not site count—that is the defining characteristic of their data centre markets. With global capacity dominated by just a few countries, and with regional demand in Asia set to skyrocket, stakeholders must read beyond the map. True insight lies in megawatts, grid access, utilisation, and scalability—not how many dots appear on a chart.

Visit Eland Cables at Data Centre World 2026

We’re proud to be the data centre power cable experts, supporting hyperscale developers and operators worldwide with high‑performance cable solutions. If you’re attending Data Centre World at London's Excel on 4–5 March 2026, come and meet our experts on Stand F100. We’d love to discuss your upcoming projects and share insights on resilient power architectures to support your infrastructure. Let’s talk - we look forward to seeing you there.